Machine Learning (17) - 회귀 / 주택 가격

회귀

회귀 실습 - 주택 가격: 고급 회귀 기법

데이터 사전 처리(Preprocessing)

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

import warnings

warnings.filterwarnings('ignore')

RMSLE로 평가

df = pd.read_csv('houseprice.csv')

df_org = df.copy()

df.head(2)

| Id | MSSubClass | MSZoning | LotFrontage | LotArea | Street | Alley | LotShape | LandContour | Utilities | ... | PoolArea | PoolQC | Fence | MiscFeature | MiscVal | MoSold | YrSold | SaleType | SaleCondition | SalePrice | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 60 | RL | 65.0 | 8450 | Pave | NaN | Reg | Lvl | AllPub | ... | 0 | NaN | NaN | NaN | 0 | 2 | 2008 | WD | Normal | 208500 |

| 1 | 2 | 20 | RL | 80.0 | 9600 | Pave | NaN | Reg | Lvl | AllPub | ... | 0 | NaN | NaN | NaN | 0 | 5 | 2007 | WD | Normal | 181500 |

2 rows × 81 columns

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1460 entries, 0 to 1459

Data columns (total 81 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Id 1460 non-null int64

1 MSSubClass 1460 non-null int64

2 MSZoning 1460 non-null object

3 LotFrontage 1201 non-null float64

4 LotArea 1460 non-null int64

5 Street 1460 non-null object

6 Alley 91 non-null object

7 LotShape 1460 non-null object

8 LandContour 1460 non-null object

9 Utilities 1460 non-null object

10 LotConfig 1460 non-null object

11 LandSlope 1460 non-null object

12 Neighborhood 1460 non-null object

13 Condition1 1460 non-null object

14 Condition2 1460 non-null object

15 BldgType 1460 non-null object

16 HouseStyle 1460 non-null object

17 OverallQual 1460 non-null int64

18 OverallCond 1460 non-null int64

19 YearBuilt 1460 non-null int64

20 YearRemodAdd 1460 non-null int64

21 RoofStyle 1460 non-null object

22 RoofMatl 1460 non-null object

23 Exterior1st 1460 non-null object

24 Exterior2nd 1460 non-null object

25 MasVnrType 1452 non-null object

26 MasVnrArea 1452 non-null float64

27 ExterQual 1460 non-null object

28 ExterCond 1460 non-null object

29 Foundation 1460 non-null object

30 BsmtQual 1423 non-null object

31 BsmtCond 1423 non-null object

32 BsmtExposure 1422 non-null object

33 BsmtFinType1 1423 non-null object

34 BsmtFinSF1 1460 non-null int64

35 BsmtFinType2 1422 non-null object

36 BsmtFinSF2 1460 non-null int64

37 BsmtUnfSF 1460 non-null int64

38 TotalBsmtSF 1460 non-null int64

39 Heating 1460 non-null object

40 HeatingQC 1460 non-null object

41 CentralAir 1460 non-null object

42 Electrical 1459 non-null object

43 1stFlrSF 1460 non-null int64

44 2ndFlrSF 1460 non-null int64

45 LowQualFinSF 1460 non-null int64

46 GrLivArea 1460 non-null int64

47 BsmtFullBath 1460 non-null int64

48 BsmtHalfBath 1460 non-null int64

49 FullBath 1460 non-null int64

50 HalfBath 1460 non-null int64

51 BedroomAbvGr 1460 non-null int64

52 KitchenAbvGr 1460 non-null int64

53 KitchenQual 1460 non-null object

54 TotRmsAbvGrd 1460 non-null int64

55 Functional 1460 non-null object

56 Fireplaces 1460 non-null int64

57 FireplaceQu 770 non-null object

58 GarageType 1379 non-null object

59 GarageYrBlt 1379 non-null float64

60 GarageFinish 1379 non-null object

61 GarageCars 1460 non-null int64

62 GarageArea 1460 non-null int64

63 GarageQual 1379 non-null object

64 GarageCond 1379 non-null object

65 PavedDrive 1460 non-null object

66 WoodDeckSF 1460 non-null int64

67 OpenPorchSF 1460 non-null int64

68 EnclosedPorch 1460 non-null int64

69 3SsnPorch 1460 non-null int64

70 ScreenPorch 1460 non-null int64

71 PoolArea 1460 non-null int64

72 PoolQC 7 non-null object

73 Fence 281 non-null object

74 MiscFeature 54 non-null object

75 MiscVal 1460 non-null int64

76 MoSold 1460 non-null int64

77 YrSold 1460 non-null int64

78 SaleType 1460 non-null object

79 SaleCondition 1460 non-null object

80 SalePrice 1460 non-null int64

dtypes: float64(3), int64(35), object(43)

memory usage: 924.0+ KB

# null 값 확인

isnull_series = df.isnull().sum()

isnull_series[isnull_series > 0].sort_values(ascending=False)

PoolQC 1453

MiscFeature 1406

Alley 1369

Fence 1179

FireplaceQu 690

LotFrontage 259

GarageType 81

GarageYrBlt 81

GarageFinish 81

GarageQual 81

GarageCond 81

BsmtExposure 38

BsmtFinType2 38

BsmtFinType1 37

BsmtCond 37

BsmtQual 37

MasVnrArea 8

MasVnrType 8

Electrical 1

dtype: int64

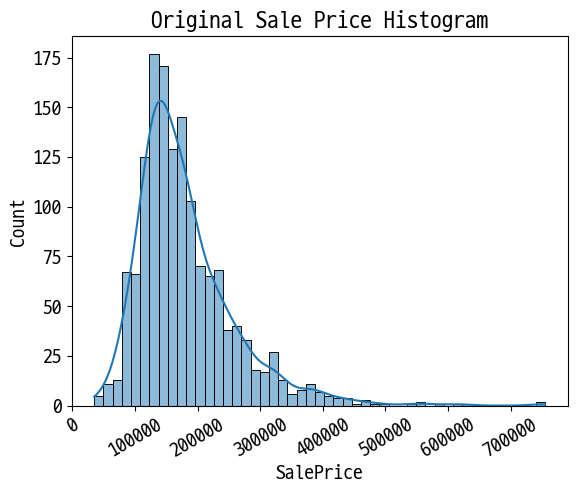

# 타깃 값의 분포 확인

plt.title('Original Sale Price Histogram')

plt.xticks(rotation=30)

sns.histplot(df['SalePrice'], kde=True)

plt.show()

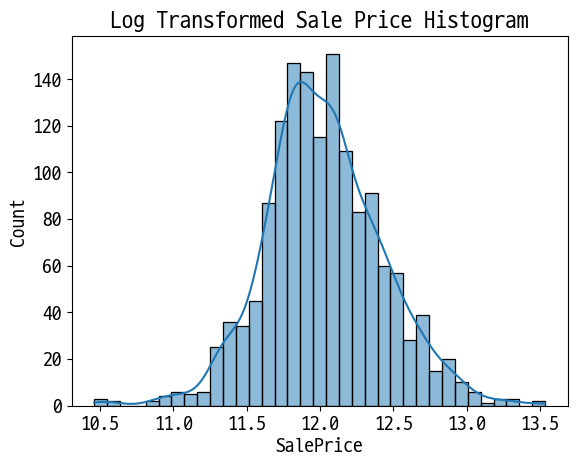

# 정규분포 형태로 변환 후 분포 확인

plt.title('Log Transformed Sale Price Histogram')

log_SalePrice = np.log1p(df['SalePrice'])

sns.histplot(log_SalePrice, kde=True)

plt.show()

# SalePrice 로그 변환

ori_SalePrice = df['SalePrice'] # 나중에 다시 확인할 용도로 백업

df['SalePrice'] = np.log1p(df['SalePrice'])

# Null이 많은 컬럼 5개, id 컬럼 제거

df.drop(columns=['Id', 'PoolQC', 'MiscFeature', 'Alley', 'Fence', 'FireplaceQu'], inplace=True)

# 숫자형 null은 평균값으로 대체

df.fillna(df.mean(), inplace=True)

# null이 남은 object형 확인

null_column_count = df.isnull().sum()[df.isnull().sum() > 0]

df.dtypes[null_column_count.index]

MasVnrType object

BsmtQual object

BsmtCond object

BsmtExposure object

BsmtFinType1 object

BsmtFinType2 object

Electrical object

GarageType object

GarageFinish object

GarageQual object

GarageCond object

dtype: object

# 문자형 원-핫 인코딩(Null도 같이 변환)

print('before:', df.shape)

df_ohe = pd.get_dummies(df)

print('after:', df_ohe.shape)

before: (1460, 75)

after: (1460, 271)

선형 회귀 모델 학습/예측/평가

from sklearn.linear_model import LinearRegression, Ridge, Lasso

from sklearn.model_selection import train_test_split

def get_rmse(model):

from sklearn.metrics import mean_squared_error

import numpy as np

pred = model.predict(X_test)

mse = mean_squared_error(y_test, pred)

rmse = np.sqrt(mse)

print(f'{model.__class__.__name__} 로그 변환된 RMSE: {np.round(rmse, 3)}')

return rmse

def get_rmses(models):

rmses = []

for model in models:

rmse = get_rmse(model)

rmses.append(rmse)

return rmses

y = df_ohe['SalePrice']

X = df_ohe.drop(columns='SalePrice')

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=156)

lr_reg = LinearRegression()

lr_reg.fit(X_train, y_train)

ridge_reg = Ridge()

ridge_reg.fit(X_train, y_train)

lasso_reg = Lasso()

lasso_reg.fit(X_train, y_train)

models = [lr_reg, ridge_reg, lasso_reg]

get_rmses(models)

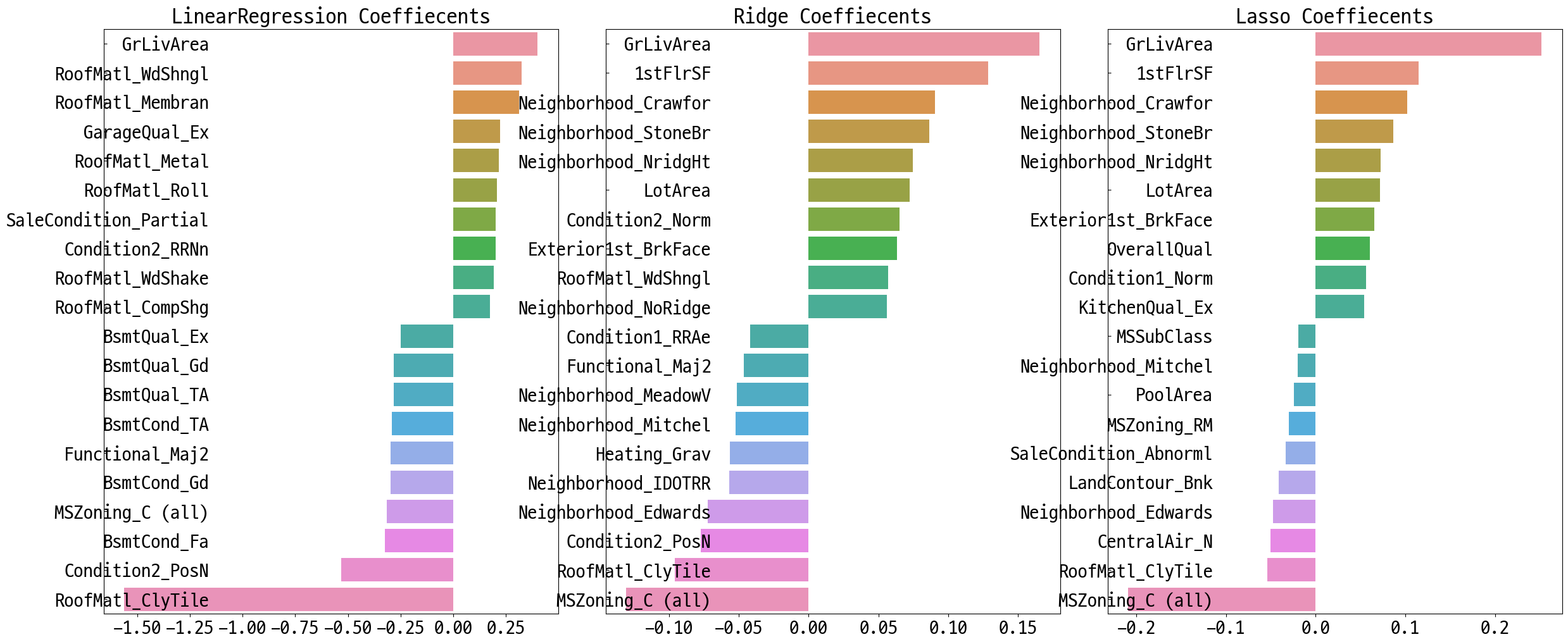

LinearRegression 로그 변환된 RMSE: 0.132

Ridge 로그 변환된 RMSE: 0.128

Lasso 로그 변환된 RMSE: 0.176

[0.13189576579154494, 0.12750846334052998, 0.17628250556471403]

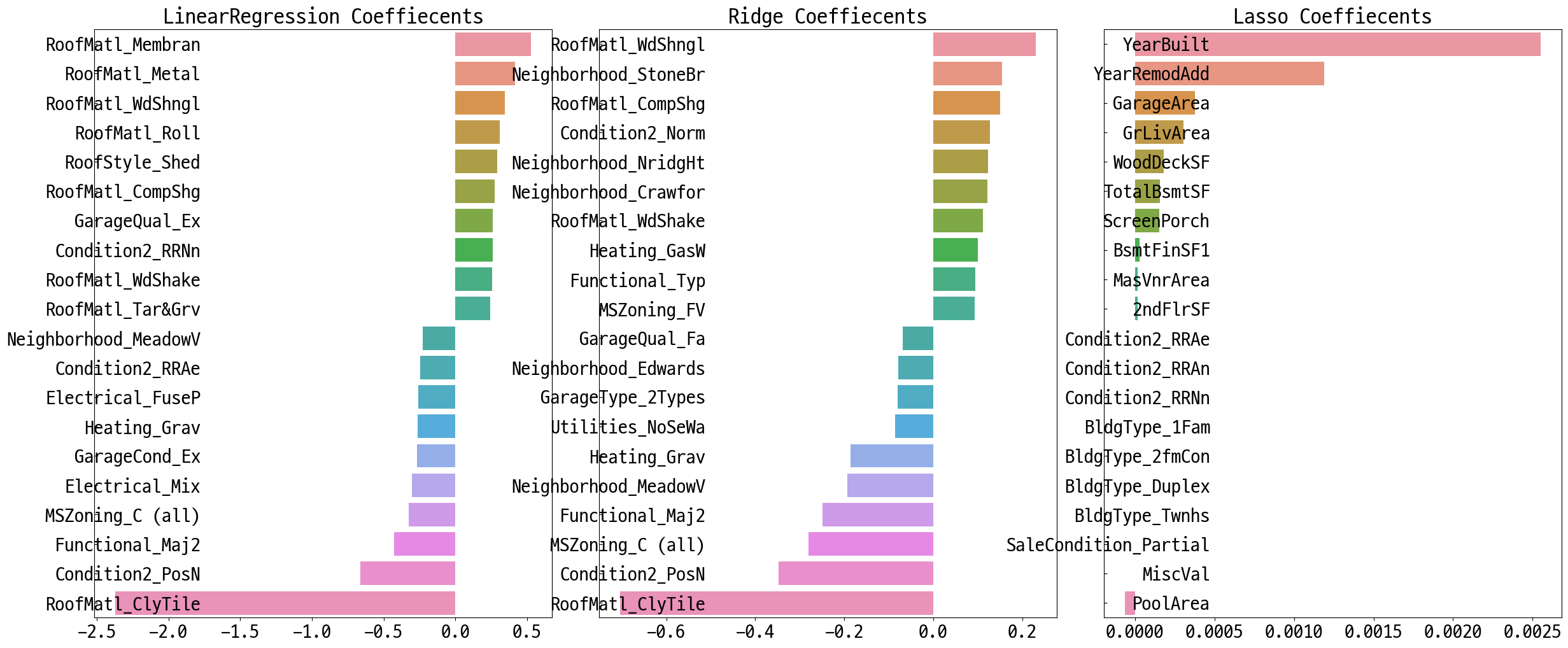

컬럼별 회귀 계수 확인

def get_top_bottom_coef(model, n=10):

coef = pd.Series(model.coef_, index=X.columns)

# 상위, 하위 n개씩 추출

coef_high = coef.sort_values(ascending=False).head(n)

coef_low = coef.sort_values(ascending=False).tail(n)

return coef_high, coef_low

def visualize_coef(models):

fig, axs = plt.subplots(figsize=(24,10), nrows=1, ncols=3)

fig.tight_layout() # plot배치를 정렬

for idx, model in enumerate(models):

coef_high, coef_low = get_top_bottom_coef(model)

coef_concat = pd.concat([coef_high , coef_low])

# ax subplot에 barchar로 표현. 한 화면에 표현하기 위해 tick label 위치와 font 크기 조정.

axs[idx].set_title(model.__class__.__name__+' Coeffiecents', size=25)

axs[idx].tick_params(axis='y', direction='in', pad=-120) # y축 tick을 -120만큼 안으로 들임

for label in (axs[idx].get_xticklabels() + axs[idx].get_yticklabels()):

label.set_fontsize(22)

sns.barplot(x=coef_concat.values, y=coef_concat.index , ax=axs[idx])

# 앞 예제에서 학습한 lr_reg, ridge_reg, lasso_reg 모델의 회귀 계수 시각화.

models = [lr_reg, ridge_reg, lasso_reg]

visualize_coef(models)

교차검증

from sklearn.model_selection import cross_val_score

def get_avg_rmse_cv(models):

for model in models:

# 분할하지 않고 전체 데이터로 cross_val_score() 수행. 모델별 CV RMSE값과 평균 RMSE 출력

rmse_list = np.sqrt(-cross_val_score(model, X, y,

scoring="neg_mean_squared_error", cv = 5))

rmse_avg = np.mean(rmse_list)

print(f'\n{model.__class__.__name__} CV RMSE 값 리스트: {np.round(rmse_list, 3)}')

print(f'{model.__class__.__name__} CV 평균 RMSE 값: {np.round(rmse_avg, 3)}')

models = [lr_reg, ridge_reg, lasso_reg]

get_avg_rmse_cv(models)

LinearRegression CV RMSE 값 리스트: [0.135 0.165 0.168 0.111 0.198]

LinearRegression CV 평균 RMSE 값: 0.155

Ridge CV RMSE 값 리스트: [0.117 0.154 0.142 0.117 0.189]

Ridge CV 평균 RMSE 값: 0.144

Lasso CV RMSE 값 리스트: [0.161 0.204 0.177 0.181 0.265]

Lasso CV 평균 RMSE 값: 0.198

하이퍼 파라미터 튜닝

from sklearn.model_selection import GridSearchCV

def print_best_params(model, params):

grid_model = GridSearchCV(model, param_grid=params, scoring='neg_mean_squared_error', cv=5)

grid_model.fit(X, y)

rmse = np.sqrt(-1*grid_model.best_score_)

print(f'{model.__class__.__name__} 5 CV 시 최적 평균 RMSE 값: {np.round(rmse, 4)}, 최적 alpha:{grid_model.best_params_}')

return grid_model.best_estimator_

ridge_params = {'alpha':[0.05, 0.1, 1, 5, 8, 10, 12, 15, 20]}

lasso_params = {'alpha':[0.001, 0.005, 0.008, 0.05, 0.03, 0.1, 0.5, 1,5, 10]}

best_rige = print_best_params(ridge_reg, ridge_params)

best_lasso = print_best_params(lasso_reg, lasso_params)

Ridge 5 CV 시 최적 평균 RMSE 값: 0.1418, 최적 alpha:{'alpha': 12}

Lasso 5 CV 시 최적 평균 RMSE 값: 0.142, 최적 alpha:{'alpha': 0.001}

lr_reg = LinearRegression()

lr_reg.fit(X_train, y_train)

ridge_reg = Ridge(alpha=12)

ridge_reg.fit(X_train, y_train)

lasso_reg = Lasso(alpha=0.001)

lasso_reg.fit(X_train, y_train)

models = [lr_reg, ridge_reg, lasso_reg]

get_rmses(models)

visualize_coef(models)

LinearRegression 로그 변환된 RMSE: 0.132

Ridge 로그 변환된 RMSE: 0.124

Lasso 로그 변환된 RMSE: 0.12

피처 데이터 왜곡 확인

from scipy.stats import skew

features_idx = df.dtypes[df.dtypes != 'object'].index

skew_features = df[features_idx].apply(lambda x: skew(x))

skew_features_top = skew_features[skew_features > 1]

print(skew_features_top.sort_values(ascending=False))

MiscVal 24.451640

PoolArea 14.813135

LotArea 12.195142

3SsnPorch 10.293752

LowQualFinSF 9.002080

KitchenAbvGr 4.483784

BsmtFinSF2 4.250888

ScreenPorch 4.117977

BsmtHalfBath 4.099186

EnclosedPorch 3.086696

MasVnrArea 2.673661

LotFrontage 2.382499

OpenPorchSF 2.361912

BsmtFinSF1 1.683771

WoodDeckSF 1.539792

TotalBsmtSF 1.522688

MSSubClass 1.406210

1stFlrSF 1.375342

GrLivArea 1.365156

dtype: float64

df[skew_features_top.index] = np.log1p(df[skew_features_top.index])

# 다시 원-핫-인코딩 후 데이터 세트 설정

df_ohe = pd.get_dummies(df)

y = df_ohe['SalePrice']

X = df_ohe.drop(columns='SalePrice')

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=156)

# 하이퍼 파라미터 튜닝

ridge_params = {'alpha':[0.05, 0.1, 1, 5, 8, 10, 12, 15, 20]}

lasso_params = {'alpha':[0.001, 0.005, 0.008, 0.05, 0.03, 0.1, 0.5, 1,5, 10]}

best_rige = print_best_params(ridge_reg, ridge_params)

best_lasso = print_best_params(lasso_reg, lasso_params)

Ridge 5 CV 시 최적 평균 RMSE 값: 0.1275, 최적 alpha:{'alpha': 10}

Lasso 5 CV 시 최적 평균 RMSE 값: 0.1252, 최적 alpha:{'alpha': 0.001}

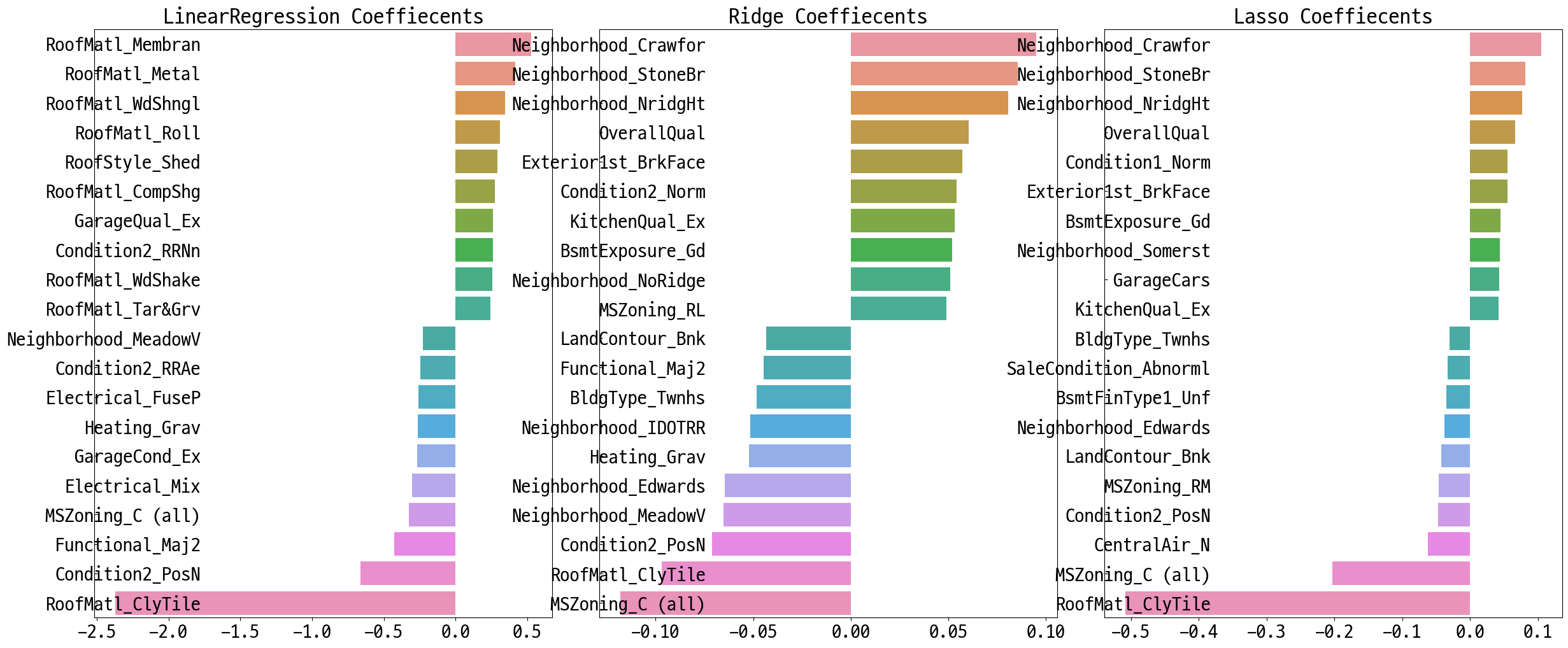

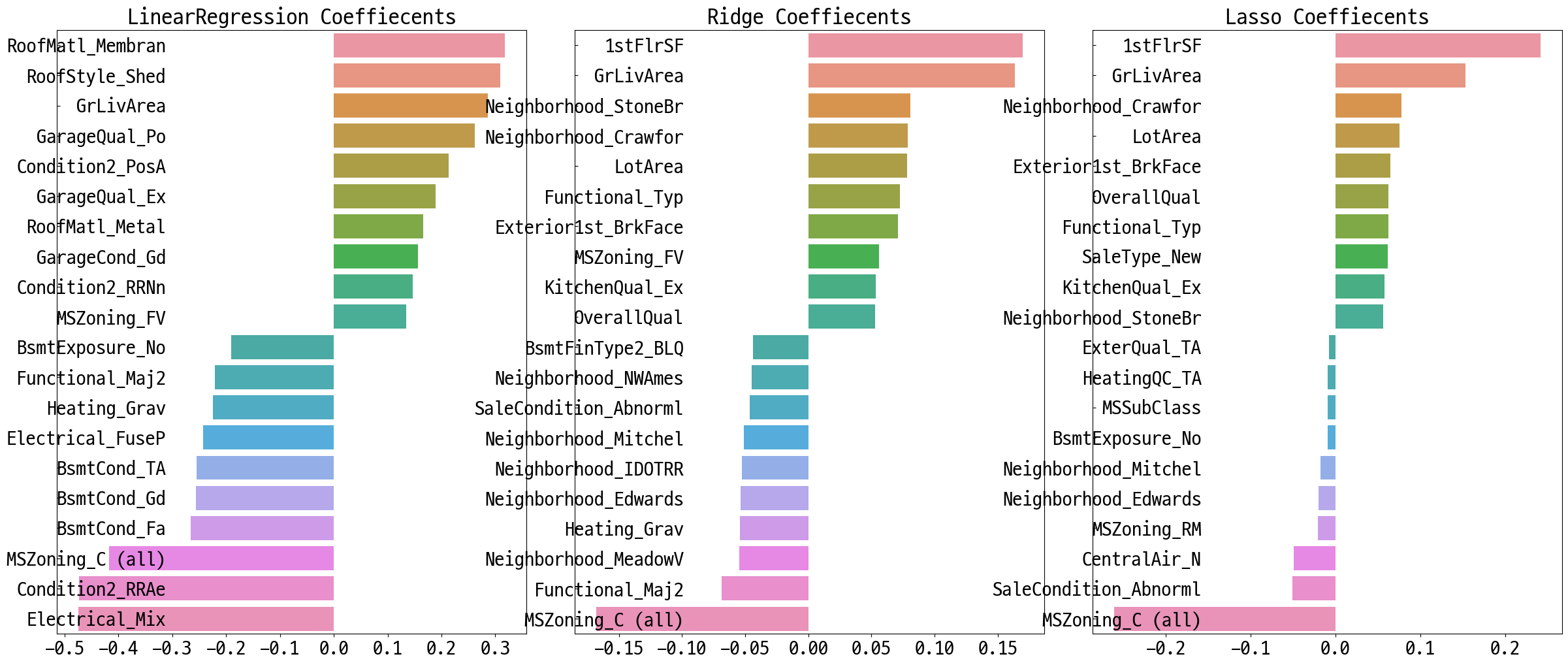

# 최적 튜닝값 적용, 컬럼별 회귀 계수 시각화

lr_reg = LinearRegression()

lr_reg.fit(X_train, y_train)

ridge_reg = Ridge(alpha=10)

ridge_reg.fit(X_train, y_train)

lasso_reg = Lasso(alpha=0.001)

lasso_reg.fit(X_train, y_train)

models = [lr_reg, ridge_reg, lasso_reg]

get_rmses(models)

visualize_coef(models)

LinearRegression 로그 변환된 RMSE: 0.128

Ridge 로그 변환된 RMSE: 0.122

Lasso 로그 변환된 RMSE: 0.119

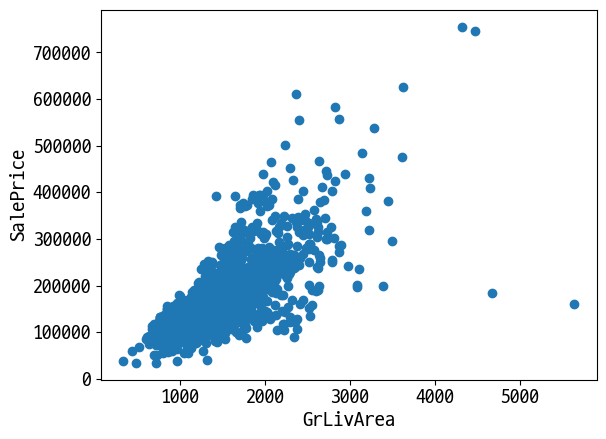

이상치 확인과 삭제

종속 변수에 가장 영향을 주는 독립 변수의 이상치 제어

plt.scatter(x=df_org['GrLivArea'], y=df_org['SalePrice'])

plt.ylabel('SalePrice', fontsize=15)

plt.xlabel('GrLivArea', fontsize=15)

plt.show()

# GrLivArea와 SalePrice 로그 변환됏으므로 이를 반영

cond1 = df_ohe['GrLivArea'] > np.log1p(4000)

cond2 = df_ohe['SalePrice'] < np.log1p(500000)

outlier_idx = df_ohe[cond1 & cond2].index

print('이상치 index:', outlier_idx.values)

print('이상치 삭제 전 df_ohe.shape:', df_ohe.shape)

이상치 index: [ 523 1298]

이상치 삭제 전 df_ohe.shape: (1460, 271)

df_ohe.drop(index=outlier_idx, inplace=True)

print('이상치 삭제 후 df_ohe.shape:', df_ohe.shape)

이상치 삭제 후 df_ohe.shape: (1458, 271)

# 데이터 세트 재설정

y = df_ohe['SalePrice']

X = df_ohe.drop(columns='SalePrice')

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=156)

# 하이퍼 파라미터 튜닝

ridge_params = {'alpha':[0.05, 0.1, 1, 5, 8, 10, 12, 15, 20]}

lasso_params = {'alpha':[0.001, 0.005, 0.008, 0.05, 0.03, 0.1, 0.5, 1,5, 10]}

best_rige = print_best_params(ridge_reg, ridge_params)

best_lasso = print_best_params(lasso_reg, lasso_params)

Ridge 5 CV 시 최적 평균 RMSE 값: 0.1125, 최적 alpha:{'alpha': 8}

Lasso 5 CV 시 최적 평균 RMSE 값: 0.1122, 최적 alpha:{'alpha': 0.001}

# 최적 튜닝값 적용, 컬럼별 회귀 계수 시각화

lr_reg = LinearRegression()

lr_reg.fit(X_train, y_train)

ridge_reg = Ridge(alpha=8)

ridge_reg.fit(X_train, y_train)

lasso_reg = Lasso(alpha=0.001)

lasso_reg.fit(X_train, y_train)

models = [lr_reg, ridge_reg, lasso_reg]

get_rmses(models)

visualize_coef(models)

LinearRegression 로그 변환된 RMSE: 0.129

Ridge 로그 변환된 RMSE: 0.103

Lasso 로그 변환된 RMSE: 0.1

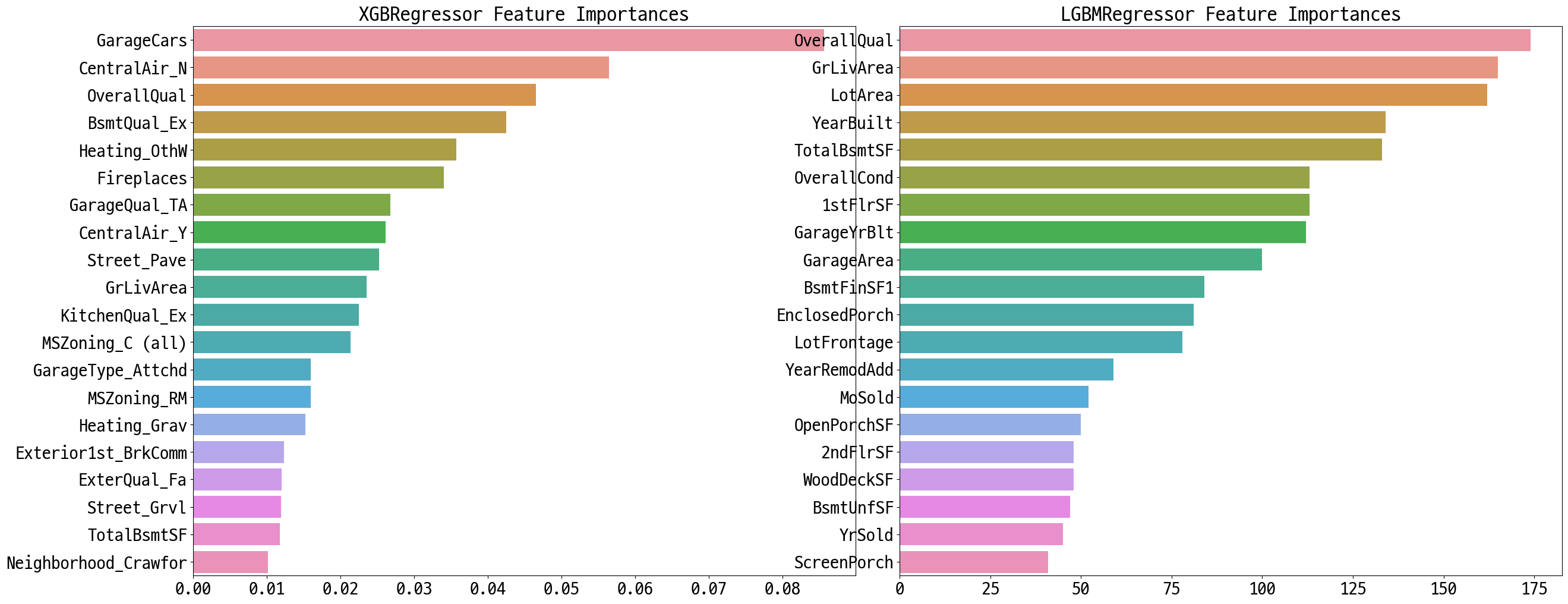

회귀 트리 모델 학습/예측/평가

from xgboost import XGBRegressor

from lightgbm import LGBMRegressor

xgb_params = {'n_estimators':[1000]}

xgb_reg = XGBRegressor(n_estimators=1000, learning_rate=0.05,

colsample_bytree=0.5, subsample=0.8)

best_xgb = print_best_params(xgb_reg, xgb_params)

XGBRegressor 5 CV 시 최적 평균 RMSE 값: 0.1178, 최적 alpha:{'n_estimators': 1000}

lgbm_params = {'n_estimators':[1000]}

lgbm_reg = LGBMRegressor(n_estimators=1000, learning_rate=0.05, num_leaves=4,

subsample=0.6, colsample_bytree=0.4, reg_lambda=10, n_jobs=-1)

best_lgbm = print_best_params(lgbm_reg, lgbm_params)

LGBMRegressor 5 CV 시 최적 평균 RMSE 값: 0.1163, 최적 alpha:{'n_estimators': 1000}

# 모델의 중요도 상위 20개의 피처명과 그때의 중요도값을 Series로 반환.

def get_top_features(model):

ftr_importances_values = model.feature_importances_

ftr_importances = pd.Series(ftr_importances_values, index=X.columns )

ftr_top20 = ftr_importances.sort_values(ascending=False)[:20]

return ftr_top20

def visualize_ftr_importances(models):

# 2개 회귀 모델의 시각화를 위해 2개의 컬럼을 가지는 subplot 생성

fig, axs = plt.subplots(figsize=(24,10),nrows=1, ncols=2)

fig.tight_layout()

# 입력인자로 받은 list객체인 models에서 차례로 model을 추출하여 피처 중요도 시각화.

for idx, model in enumerate(models):

# 중요도 상위 20개의 피처명과 그때의 중요도값 추출

ftr_top20 = get_top_features(model)

axs[idx].set_title(model.__class__.__name__+' Feature Importances', size=25)

#font 크기 조정.

for label in (axs[idx].get_xticklabels() + axs[idx].get_yticklabels()):

label.set_fontsize(22)

sns.barplot(x=ftr_top20.values, y=ftr_top20.index , ax=axs[idx])

# 앞 예제에서 print_best_params()가 반환한 GridSearchCV로 최적화된 모델의 피처 중요도 시각화

models = [best_xgb, best_lgbm]

visualize_ftr_importances(models)

회귀 모델들의 예측 결과 혼합을 통한 최종 예측

def get_rmse_pred(preds):

from sklearn.metrics import mean_squared_error

for key in preds.keys():

pred_value = preds[key]

mse = mean_squared_error(y_test , pred_value)

rmse = np.sqrt(mse)

print(f'{key} 모델의 RMSE: {rmse}')

# 개별 모델의 학습

ridge_reg = Ridge(alpha=8)

ridge_reg.fit(X_train, y_train)

lasso_reg = Lasso(alpha=0.001)

lasso_reg.fit(X_train, y_train)

# 개별 모델 예측

ridge_pred = ridge_reg.predict(X_test)

lasso_pred = lasso_reg.predict(X_test)

# 개별 모델 예측값 혼합으로 최종 예측값 도출

pred = 0.4 * ridge_pred + 0.6 * lasso_pred

preds = {'최종 혼합': pred,

'Ridge': ridge_pred,

'Lasso': lasso_pred}

#최종 혼합 모델, 개별모델의 RMSE 값 출력

get_rmse_pred(preds)

최종 혼합 모델의 RMSE: 0.10007930884470506

Ridge 모델의 RMSE: 0.10345177546603253

Lasso 모델의 RMSE: 0.10024170460890033

xgb_reg = XGBRegressor(n_estimators=1000, learning_rate=0.05,

colsample_bytree=0.5, subsample=0.8)

lgbm_reg = LGBMRegressor(n_estimators=1000, learning_rate=0.05, num_leaves=4,

subsample=0.6, colsample_bytree=0.4, reg_lambda=10, n_jobs=-1)

xgb_reg.fit(X_train, y_train)

lgbm_reg.fit(X_train, y_train)

xgb_pred = xgb_reg.predict(X_test)

lgbm_pred = lgbm_reg.predict(X_test)

pred = 0.5 * xgb_pred + 0.5 * lgbm_pred

preds = {'최종 혼합': pred,

'XGBM': xgb_pred,

'LGBM': lgbm_pred}

get_rmse_pred(preds)

최종 혼합 모델의 RMSE: 0.10170077353447762

XGBM 모델의 RMSE: 0.10738295638346222

LGBM 모델의 RMSE: 0.10382510019327311

Reference

- 이 포스트는 SeSAC 인공지능 자연어처리, 컴퓨터비전 기술을 활용한 응용 SW 개발자 양성 과정 - 심선조 강사님의 강의를 정리한 내용입니다.

댓글남기기